Faron Pharmaceuticals — A Share Issue Would Drive Value

An equity raise could accelerate Phase III development, preserve commercial rights, and maximize shareholder value.

As the new shares from last summer’s equity raise reach their first trading anniversary, this overview examines Faron’s financing avenues.

A partnership agreement alone does not generate value at this stage; it is simply one financing avenue among many. Last year, in conjunction with the offering, Faron indicated that it would require partner resources to execute Phase III. Over the past year, however, Faron’s market valuation has increased by more than 2.5×, meaning the company now possesses the capacity to self-fund Phase III through equity raise(s).

The cash cost of Phase III remains constant in euros, whether funded externally or internally. Yet the true cost can also be expressed in terms of dilution. Last summer, approximately €30 million was raised at a roughly 30 % discount to TERP—a highly successful outcome.

Today, a comparable transaction securing €40 million in gross proceeds could almost certainly be executed at a €1.50 subscription price, which—assuming a €2.30 share price—equates to an approximate 40 % discount to TERP. This would necessitate issuing roughly 27 million new shares, representing under 20 % dilution for existing shareholders.

CEO Mr. Jalkanen and the Faron team have demonstrated a solid track record of successful capital raises, and this transaction might not require costly underwriting commitments; it could proceed smoothly on its merits. By pursuing this course, Faron would:

Advance rapidly into Phase III without partner-related delays, thereby creating intrinsic value; and

Retain full commercial rights

Negotiating a partnership could extend over several years, postponing market entry and reducing the net present value of future cash flows for shareholders. In the Nordics alone, numerous firms have a Phase III–ready asset but are still waiting for a partner. For instance, Initiator Pharma in Denmark has been engaging potential collaborators since its Phase II study concluded in 2023. To retail investors in Finland, Faron appears as a guiding beacon in the morning mist—yet to large pharmaceutical companies, it remains merely one of many prospects. Moreover, Faron’s Phase II study will not report for several months, so the true waiting period has yet to commence.

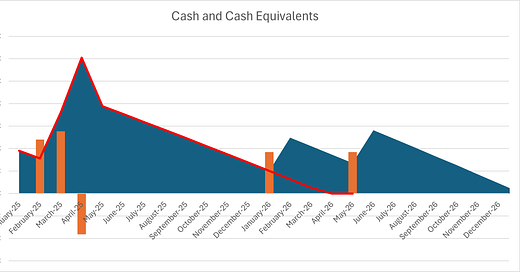

A key differentiator for Faron is its independence: the company is not reliant on an external partner and could self-finance the Phase III study. This advantage may not endure indefinitely since Faron is no longer the “lean, mean, killing machine” as Dr. Jalkanen described the company following last year’s cost-cutting measures.

Cash burn is accelerating once again, and scrutiny of the balance sheet will intensify as further funds will likely be required, even if a partnership is secured. Of the HCM top-up bonds, the first issuance condition has been narrowly satisfied, but the remaining two conditions rest entirely with market performance:

a) A Phase II topline readout for the BEXMAB r/r MDS study indicating an objective response rate ≥ 60 %

b) A three-month average daily trading value of the shares exceeding €500,000 prior to the second-tranche bond issuance

c) A market capitalisation > €200 million on the date of issuance of the second-tranche bonds

Given typical market volatility, there is a material risk that Faron’s market capitalisation could dip below €200 million when additional funds are required. Acting promptly to minimise this uncertainty is therefore prudent. Upon a successful €40 million raise, the market cap would remain above €200 million, securing funding through the Phase III interim readout—assuming any outstanding HCM bonds are redeemed as needed.

Current market terms for a potential partnership would likely include:

• Costs shared on a 50/50 basis

• A $50 million upfront payment

• Up to $600 million in milestone payments

• 10 % royalties

Potential partners are not modelling a > 60 % Likelihood of Approval (LoA); their assumptions are conservatively lower. Given today’s market environment, superior deal terms are unlikely, while small biotech firms line up seeking collaborations.

Consequently, Faron’s valuation expectations and those of potential partners may not align—another rationale for self-funding Phase III. Once interim data are available, visibility will improve, transforming forecasting from art into science as uncertainty diminishes.

Following a successful interim readout, the intrinsic value created would allow Faron to negotiate substantially enhanced terms—potentially doubling every financial parameter—while partner interest would surge. Shareholders would realise significant value creation and wealth generation.

Total dilution from a €40 million equity raise plus two HCM bond issuances would amount to approximately 27 M + 5 M + 5 M = 37 M new shares, or 24 % dilution. On a risk-adjusted basis, long-term value creation would be compelling, even if the share price experiences short-term pressure.

We look forward to hearing more from the company. Has the Board revisited the financing strategy since last summer? Does it genuinely believe that partnering—amid what may be the weakest market in a decade—offers the optimal path to maximise shareholder value under the current—undeniably favourable—capital-raising conditions?

The information presented in this blog is provided solely for educational and informational purposes and does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument. The views expressed are those of the author and may change without notice. You should not rely on this content as the basis for making any investment decision, and nothing herein guarantees future performance of any market or security. The author is not a regulated financial advisor or any other licensed financial services provider. Prior to taking any action, you are strongly encouraged to conduct your own research and seek guidance from a qualified financial professional who can take into account your individual circumstances and risk tolerance.